How to Build a Fintech App Like NerdWallet: Features, Costs & Compliance in 2025

Managing money on your own is one of the constant struggles of adulting that people these days face. Finance is always a serious point to make. If you want to offer solutions to the problem, then you are definitely in the right direction.

In 2025, over 64% of U.S. adults say they’re stressed about finances, and they’re turning to apps that make things easier, not harder.

Personal finance management applications have turned to more than tracking budgets. Most people compare credit cards, find the right loan, boost their credit score, and get real advice from these applications. With so much to explore, there is no question that people love these apps to make smarter financial decisions.

If you have a personal finance solution idea, it’s an amazing opportunity. Consult our Flutter app engineers today for roadmap and cost estimation.

For startups and businesses, that’s a huge opportunity. Whether it’s helping young professionals plan their future or giving families better loan options, there are plenty of untapped niches waiting to be explored.

In this guide, we’ll show you how to build a fintech app that stands out. From must-have features to compliance and cost breakdowns—you’ll get everything you need to get started.

What is a Fintech App?

A fintech app is a mobile or web application that uses technology to help people manage their finances. “Fintech” stands for financial technology, and these apps are designed to make money-related tasks faster, easier, and more convenient.

Instead of going to a bank or financial advisor, users can use fintech apps to:

- Track their spending and savings

- Compare credit card or loan options.

- Make payments or transfer money.

- Monitor their credit score.

- Invest in stocks or cryptocurrencies.

- Get personalized financial advice.

Some apps focus on a single task, like budgeting, while others combine multiple services in one platform. Many also use artificial intelligence (AI) to provide smarter recommendations based on the user’s behaviour and goals.

Fintech Application Market Growth and Projection

Fintech apps are popular because they give people more control over their money, anytime, anywhere. They’re especially helpful for people who want to make better financial decisions without needing expert knowledge.

- The global fintech market is projected to generate impressive revenue in the coming years, with estimates reaching $1.5 trillion by 2030.

- The Asia-Pacific (APAC) region is expected to see the largest growth in the fintech market, with emerging markets driving growth and promising high growth in digital adoption.

- While traditional banks look to see slower growth, fintech firms are expected to show significantly higher revenue growth.

Understanding the Success of NerdWallet

NerdWallet, started in 2009 as a tool to simply compare credit cards, quickly grew into one of the most trusted personal finance platforms in the U.S. In its journey, NerdWallet has gone from steady growth and adding products to going public. Back in 2009, the company focused on finding a true financial need in the marketplace. NerdWallet has demonstrated that you can build a long-term solution to financial needs with a clear, concise, and repeatable model.

Core Functions That Give the App an Upper Hand

These core functions set us apart from competitors:

- Credit Score Monitoring: Users can monitor their credit score regularly and receive updates and tips on how they can improve their score, empowering them to make more informed choices when borrowing, refinancing, or improving their credit health.

- Credit Card & Loan Comparisons: Users can compare financial products easily. Side by side comparisons provide accurate information, filters, and ratings to help users determine their best-fit options—without needing to rummage through dozens of websites.

- Budgeting Tools: Users can segregate their spending, establish goals, and reflect on their spending habits in a clear and simple way. Budgeting doesn’t need to feel overwhelming anymore.

- Financial Education: NerdWallet’s financial content takes complex financial concepts and simplifies them in a way users understand. This approach builds trust with users and brings them back to NerdWallet not just for tools, but ultimately for guidance.

Must-Have Features for Your NerdWallet-Inspired Fintech App

Core Features to Include in Your Fintech Application

If you want to build a fintech application that your users can trust and rely on, here are some of the features to include:

Get Safe Credit Score Integration

As you get ready to enter the market, try partnering with trusted bureaus like Experian, TransUnion, and Equifax to let users access their credit score via an integrated API. This allows users to stay on top of their credit health, track changes, and take the right action when needed.

Easy Budgeting and Expense Tracking

When we talk about a budgeting system, it must offer smart categorization, splitting bills, utilities, or subscriptions, along with just listing the expenses. It should reflect visual summaries that make spending patterns easy to understand and enable actionable decisions.

Effective Financial Goal Setting

Goal tracking helps users stay motivated to save for a vacation or pay off their debt. With extended features like progress bars, milestone alerts, and auto-adjusting plans based on their income and expenditure can make setting dynamics achievable.

AI-powered Spending Insights

With unusual activities, your application can recommend ways to cut down on recurring charges or suggest ways to optimize users’ spending. A user may be notified of money-saving ideas or be guided to set monthly budgets to better guide them.

Financial Product Comparison

Let your users explore up-to-date comparisons on credit cards, loans, insurances, and whatnot. With well-defined filters like rate of interest, fees, terms, perks, etc. backed by real-time data you allow users to make quick informed decisions.

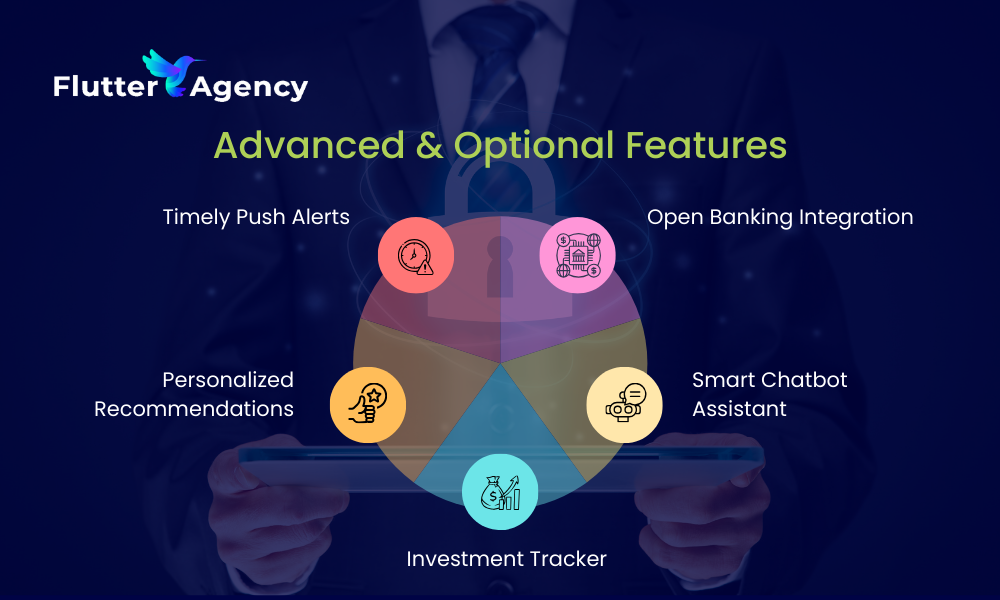

Advanced & Optional Features

Considering the advancement in technology and changing consumer behaviour, you must integrate features for Generation Gen.

- Seamless Open Banking Integration

- Intelligent Chatbot-Based Financial Assistant

- Integrated Investment Tracker

- Personalized Product Recommendation

- Timely Push Alerts The

The Right Tech Stack to Develop a Secure and Scalable App like NerdWallet

Frontend

- Flutter (for efficient cross-platform performance and faster development).

- GetX/Bloc for better state management

Backend

- Robust Node.js / Scalable Django / Enterprise-grade .NET Core.

- Reliable PostgreSQL Flexible DB for data storage.

- Secure and scalable cloud hosting on AWS / Azure / Google Cloud.

Crucial APIs

- Secure financial data access via Plaid or MX.

- Real-time credit scores through Experian API.

- Secure payment processing with Stripe.

- In-depth user behavior analytics with Segment + Mixpanel.

Navigating U.S. Compliance & Ensuring Ironclad Security for Your Fintech App

Legal Compliance in the U.S.

- PCI DSS: The compliance was brought to action to let applications securely process and store payment data, protecting users from fraud, and minimizing the risk of costly data breaches.

- GLBA (Gramm-Leach-Bliley Act): Adhering to the compliance allows you to protect users’ financial information and disclose data-sharing practices—non-compliance can lead to legal action and reputational damage.

- CCPA (California Consumer Privacy Act): Grants California users the right to know, access, and control their personal data, making user consent and transparency legally and ethically critical.

- SOC 2: Proves your platform meets high standards for data security and operational integrity, which builds credibility, especially with enterprise partners and investors.

Implementing Robust Data Security Measures

- End-to-end encryption (AES-256): All user data is encrypted when at rest and in transit making it unreadable by any unauthorized person.

- Multi-factor Biometric Authentication (Face ID, Touch ID): Provides additional protection during log-in by enabling verification of account users.

- Secure Session Management utilizing OAuth2.0 / JWT: Protocols ensure sessions cannot be hijacked by verifying the identity through tokens.

Apps like Mint earn your trust by encrypting all sensitive data in transit and at rest. Encrypt sensitive information and feel safer by implementing multi-factor authentication to secure access to accounts.

Strategic Monetization Strategies for Your Fintech App

Monetizing your fintech app doesn’t have to feel like you’re selling something. If done correctly, it can provide users with a new experience while still providing a good revenue stream. Here are four smart ways to make it happen:

Affiliate Partnerships That Make Sense

A possible win-win with partnerships for credit cards, loans, or insurance is directing your users to potentially trusted providers, and if someone applies for a product through your app, you get a kickback. One clear caveat: Be sure you are only recommending legitimate, helpful providers. Your users are using your app to help guide their financial decisions, and if something backfires, it will reflect poorly on you.

Sponsored Listings (with lots of clarity)

If your app has any comparison components – for example, letting users know the top savings accounts or insurance provider rates – you can sell paid placements for providers in your app. Just be clear where the placements are paid for. Being transparent with users aids in trust building, and users are more likely to appreciate why a product was first on the listing.

Premium Features Users Will Pay For

There are certain features most of your users will pay for if it, in addition to the free version, improves their experience; these may include the advanced budgeting tools for tracking, a user’s credit score tracking, or priority support. The key here is to ensure that the premium features add to their life, not because you are selling something.

Relevant, Non-Invasive Advertisements

If you’re running a blog or providing useful content in-app, you can include advertisements for financial services or tools. These ads should be relevant and passive—advertising should be part of the experience, not something users dislike and find to be intrusive.

Realistic Development Timeline & Essential Team Structure to Create an App like NerdWallet

When creating a fintech app, there is no need to rush; with the right team and plan, the whole process can be efficient, easy, and fluid. Here is a breakdown of what typically happens and who is involved.

1. Discovery & Planning (2–3 weeks)

This is where it all begins. A Product Manager and a Business Analyst meet, define the purpose of the app, research the audience, and agree on features and functionality. The goal is to be completely clear about what you are building before writing code.

2. UI/UX Design (3–4 weeks)

At this point, the app will start to take form—not in terms of functionality, but visually. A UI/UX Designer will create wireframes and develop layouts, thinking about user flow and a clean, simple, intuitive experience. This step is important for ultimately determining whether your app looks good and whether it is good to use.

3. Development – Frontend & Backend (10–16 weeks)

This is where the work gets done. Frontend Developers will develop the components of the app that users will see and interact with, while Backend Developers establish all of the components of the app that happen behind the scenes, i.e. on the server, the database, and the logic of the app. The time taken on this step depends primarily on the complexity of the features you are implementing.

4. API Integration (2-3 weeks)

Time to connect your app to the outside world: payment processors, credit bureaus, etc. Your Backend Developer will take care of all the technical hookups, and your QA Engineer will verify that everything works perfectly.

5. Testing & QA (3-4 weeks)

Bug hunting time! Your QA Engineer will walk-through the app front-to-back and look for issues, so they aren’t encountered by your users. It’s all about the launch!

6. Deployment & Support (Ongoing)

Your DevOps Engineer will make the app live, and your support team is ready if users run into anything as they start to use it.

Transparent Estimated Development Cost

If you’re budgeting for a fintech app, it’s important to understand that prices can vary depending on scope and complexity (not to mention the team that you choose to build your app). Let’s break this down transparently so you can get a sense of realistic expectations:

Basic MVP (Minimum Viable Product): $35,000 -$50,000

If you’re an early-stage fintech company and want to launch your product but only have the capital to launch the must-have features, a basic Minimum Viable Product (MVP) is your best bet. With that budget, you’re able to have a working MVP that at the very least consists of the following must-have features: user onboarding, account linking, simple dashboards, and some basic analytics for the user. This is an ideal budget-level product for anyone wanting to test the market before fully investing in a full-scale app build-out.

Full-Featured App: $80,000 – $150,000+

Do you think you want to go all in? A full-featured fintech app will have budgeting tools and all the features of a basic MVP, but will also include advanced features, including personalized recommendations, real-time financial data capabilities, and the app should also have access to smooth third-party integrations! This level is also able to include security measures, compliance features, and a high-quality user experience.

Key Elements Driving Cost

- Third-Party APIs: Integrating services like Plaid, Experian or Yodlee brings integration fees, plus charges for each time your app is used that can significantly add up.

- Compliance with Regulation: Navigating through financial regulations (KYC, AML, and GDPR, etc.) is basic, but it is time-consuming and expensive.

- Security of Data: Implementing the encryption standard applicable to your app and the right cloud infrastructure requires some curation of security skills, time, and effort.

- Location of Development Team and Their Level of Experience: Using a hybrid team (in the U.S. and offshore) can help create a cost to quality balance and usually developers that are more experienced cost more.

So if anything, clear planning and intentionality around the MVP will help reduce costs. But the more complex an app is, the more complex the investment in the app is.

Why Flutter Agency is Your Perfect Fintech Development Partner

It can be the difference between success or failure – picking the correct development partner for your fintech app. At Flutter Agency we bring technical expertise, industry knowledge, and a tried-and-true approach to build a secure, scalable fintech solution – particularly for the U.S. market.

Industry-Relevant Fintech Knowledge

We are focused on getting you a compliant and secure fintech app because compliance is not an afterthought – we care about compliance from day 1. We know that the fintech world is heavily regulated, and compliance from PCI-DSS and SOC 2 to GDPR and KYC/AML has to be thought of from day 1.

Proven API Experience

We have experience working with the building blocks for your fintech application because we’ve directly worked with them all – Plaid, Stripe, Experian, MX, etc. There’s a complexity to fintech apps and payment processing through APIs, whether you are linking bank accounts or verifying identity, and you want to work with someone who knows how to securely integrate into these solutions.

Full-Cycle & Development Process

We are developers, but we are more than that – we will help you throughout the full development process, from ideation, to secure system architecture, to frontend/backend development, to build testing, launch, and support after launch. You will be able to have a true partner in your business and your success.

Conclusion: Your Opportunity to Shape the Future of Fintech

There’s more to building a successful fintech app like NerdWallet in 2025 than great code. You need deep domain knowledge, seamless user experience, and ironclad security. With the rise of AI, open banking, and new fintech regulations, now is the time to invest in smart, consumer-centric financial experiences. Future-ready trends like hyper-personalization, embedded finance, and blockchain have changed how consumers interact with money, and your app can lead the way.

If you’re prepared to take your idea and make it into a secure, user-friendly fintech app that appeals to U.S. users, contact us today to schedule a FREE, comprehensive consultation, and let’s get started building.

Contemporary ventures

Recent blog

ready to get started?

Fill out the form below and we will be in touch soon!

"*" indicates required fields